AP Automation Designed for SAP Business One — Qnomix

Built with Indian GST compliance in mind — full invoice verification, e-invoice validation, HSN & value matching, and seamless one-click posting into SAP B1.

- GST‑Compliant Validation — Vendor and Buyer GST return history & e‑invoice verification before posting.

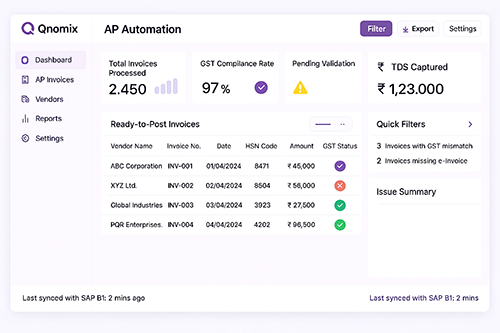

- One‑click Post Screen — View all Ready‑to‑Post AP entries on a single screen and post instantly.

- Auto‑Post Invoices with TDS capture from BP Master and configurable validations.

Performance at a Glance

Audit‑Ready Compliance

Key Features

GST‑First Validation

Validation based on Vendor & Buyer GST filing history. If the vendor has not generated an e-invoice, AP posting is blocked to avoid input tax credit issues.

– HSN code & value matching before posting

– GST filing history verification

– Automatic exception flagging with corrective notes

One‑Click Ready‑to‑Post Screen

A smart dashboard that shows all Ready-to-Post invoices, highlighting validation errors on screen. Post with a single click.

– On‑screen error messages (GST mismatch, HSN mismatch, missing e‑invoice)

– Bulk select, post, or undo options

– Audit trail and approval integration

Auto AP Posting & TDS Capture

Withholding Tax(TDS) is automatically captured from BP Master. Supports both Auto-Post and Manual Post Modes.

– TDS slab and PAN/TAN checks from BP master

– Automatic journal creation with tax breakups

– Configurable posting rules per company/branch

Faster Posting

During GRPO creation, the system validates HSN, total value, rates, and quantities against PO. Any mismatch is blocked or raised as an exception.

– Line‑level quantity and rate validation

– HSN consistency across PO → GRPO → Invoice

– Configurable tolerance percentages

How It Works

1. GST & HSN Verification

System checks e-invoice existence, vendor GST filing history, HSN codes, and taxable amounts.

2. Matching & Validation (PO/GRPO)

2-way and 3-way matching with configurable tolerances. Validates HSN, quantity, and rates.

3. Ready-to-Post Dashboard

All validated invoices appear in one dashboard. Issues highlighted for review before posting.

4. Auto-Post & Reconciliation

In auto-post mode, SAP B1 Journals / AP Invoices generated automatically with audit trail.

5. Reconcile & Audit

System performs reconciliation and stores a complete audit trail for GST returns and audits.

Benefits

Compliance-First

GST rules & e-invoice checks reduce risk of tax credit issues.

Faster Posting

Process AP invoices much faster than manual entry with fewer errors.

Accurate Payments

Vendor compliance history ensures correct payments.

Cost Savings

Reduces AP operation cost with automation and lowers manual effort.

Full Visibility

System provide transparency across invoice stages, approvals, and payments.

Audit-Ready

Complete audit trails simplify GST return filing and audits.

Ready to Get Started?

Request a demo of Qnomix AP Automation and see how GST‑compliant AP processing can be automated in your SAP B1 system.

Email: sales@qnomix.com

Phone: +91‑8128313176 / +91-7383135590